Qualified VA borrowers now have access to one of the most simple and effective refinance alternatives available: the VA Interest Rate Reduction Refinance Loan (VA IRRRL), often has known as a VA Streamline refinance.

VA Streamline refinance loans are quite simple and may be completed quickly since homeowners are switching from one VA loan product to another.

A VA IRRRL, pronounced “VA earl,” is a mortgage refinance option for veterans who have an existing VA loan. The IRRRL enables homeowners to refinance an existing VA loan into a new VA loan with a reduced interest rate or to convert an adjustable VA loan to a fixed rate.

It is sometimes referred to as a VA streamline since it involves fewer paperwork and is completed faster than a regular refinancing.

Many veterans refinance to lessen their existing mortgage interest rate. IRRRL rates may differ from home-purchase rates. Here are today’s VA IRRRL rates.

When refinancing, the change in rate or terms must be significant enough to give concrete benefits, such as decreased monthly payments or a fixed interest rate rather than an adjustable rate.

Each VA refinancing scenario is unique. Discuss your individual circumstances with a loan officer, who will run the figures and assist you choose what makes the most financial sense.

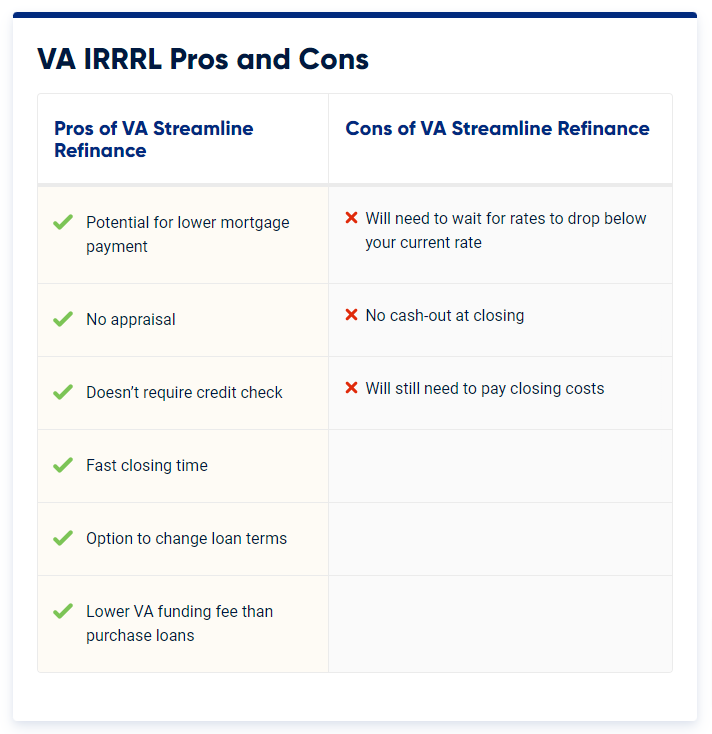

There are numerous significant benefits to using an IRRRL, including little or no out-of-pocket expenditures and, in most cases, no VA assessment.

To prevent out-of-pocket expenses, homeowners might choose to roll closing charges and fees into their loan balance.

With a 0.5 percent decrease, a borrower may potentially save tens of thousands of dollars over the course of a loan.

Let’s look at a brief example with the identical loan conditions (30-year fixed rate) but three different interest rates.

Savings and interest rates listed here are indicative only and may fluctuate depending on a variety of variables. All loans need approval and verification of eligibility, and they are subject to the full terms and conditions indicated in the loan agreements.

Want to discover how much you may save with a VA refinance? Contact our Va loan Refinance team to estimate your savings and monthly payments.

You may be qualified for a VA IRRRL if you financed the property with a VA loan and can demonstrate that you now or formerly resided in the residence.

The IRRRL is not available to veterans with non-VA loans. Veterans with non-VA loans looking to refinance to a VA loan can use the VA Cash-Out refinancing option.

Lenders may also have restrictions and standards for how long you’ve been in your existing mortgage, how many payments you’ve made, and how long it will take to recuperate the expenses and fees connected with the new loan.

VA IRRRLs offer more flexible standards for work and income. Your lender may still demand two years of job history, but they are unlikely to assess income or asset statistics unless the new mortgage payment would increase by more than 20% or there are worries about income stability.

Another key IRRRL reminder is that the VA Streamline refinancing needs just prior occupancy of the house. Unlike VA home purchase loans, you do not have to plan to live in the property as your primary residence.

Finally, the maximum loan period is the original VA loan plus 10 years, not to exceed 30 years and 32 days. For example, a Veteran refinancing a VA loan with a 15-year term may be eligible for an IRRRL with a maximum duration of 25 years.

Lenders may have different norms and policies regarding credit scores, appraisals, loan-to-value ratios, and other factors.

SDVA Homes presently requires homeowners who are refinancing a VA IRRRL loan to have no 30-day late payments in the previous 12 months. The commencement date of your new refinance loan must be at least 240 days after you make your first monthly payment on the refinanced loan and 7 full monthly payments on the original loan.

Our loan-to-value (LTV) limit is now 110% for select Streamline refinances, which include the financing of all closing expenses, prepaid escrow money, the VA Funding Fee, and any eligible energy-efficiency enhancements. LTV ratios simply compare the mortgage amount to the assessed value.

We also expect that charges and fees be recouped within 36 months or less. This estimate excludes escrow monies. Other standards and criteria may apply to interest rate savings.

In addition, we demand verbal proof of employment prior to closing, and an appraisal if the base loan amount exceeds $1 million.

There is no need for a hard credit inquiry; instead, a soft credit pull will be conducted at closing.

The VA financing charge is an upfront cost that is applied to all buy and refinance loans. The proceeds of this charge are sent directly to the Department of Veterans Affairs and used to cover losses on any loans that may fall into default.

The good news is that the VA financing fee for IRRRLs is lower than for traditional VA purchase and cash-out loans. Borrowers who are not exempt pay a 0.5% financing charge on their IRRRL. Borrowers can apply the VA financing fee to their loan balance.

Our VA Funding charge Calculator will help you estimate the cost of your funding charge.

Homeowners who get compensation for a service-related disability, qualifying surviving spouses, and certain individuals are excluded from the financing charge.

Keep in mind that refinancing may result in increased finance costs over the term of the loan.

The acronym IRRRL stands for Interest Rate Reduction Refinance Loan. It’s also known as the VA Streamline.

Generally, borrowers on the previous VA loan must be on the new IRRRL unless an applicant dies or divorces. Lenders cannot seek to remove a presently married or separated spouse from the new loan if they are still liable to the old one.

VA IRRRLs are unique when it comes to VA loan eligibility. Obtaining an IRRRL does not necessitate the usage of a new or extra entitlement. Regardless of the loan size, the amount of VA loan entitlement utilized to finance the previous purchase loan is carried over to the new loan.

A greater or lower loan amount on the IRRRL might alter the guarantee amount, which represents how much lenders would reclaim in the case of default. It does not, however, change the amount of a Veteran’s already utilized entitlement.

An IRRRL is typically a type of refinancing in which no cash out is permitted. However, up to $6,000 in extra funds can be borrowed to pay the cost of eligible energy efficiency upgrades done within 90 days after closing. Request further information from your lender.

Closing expenses and fees for a VA IRRRL vary by lender, but are generally between 3% and 5% of the loan amount. Borrowers can often incorporate these charges into the final loan amount rather than paying them up front. Ask your lender for further information, or contact a SDVA Homes loan representative at +1 (916) 548-3942.

Refinancing to a 15-year mortgage is both possible and usual. A shorter loan will have a lower total interest expense over time than a 30-year mortgage. However, the monthly payments on a 15-year mortgage may be much greater.

Consider both the monthly payments and the lifetime interest charges to determine whether a mortgage with a shorter term makes sense.

Refinancing may result in increased financing costs throughout the course of the loan.

Refinancing may result in increased financing costs throughout the course of the loan

Getting started with a VA Streamline refinancing is simple.

NEXT STEP:

Start Your VA Home LoanCONTINUE READING: